Real estate management

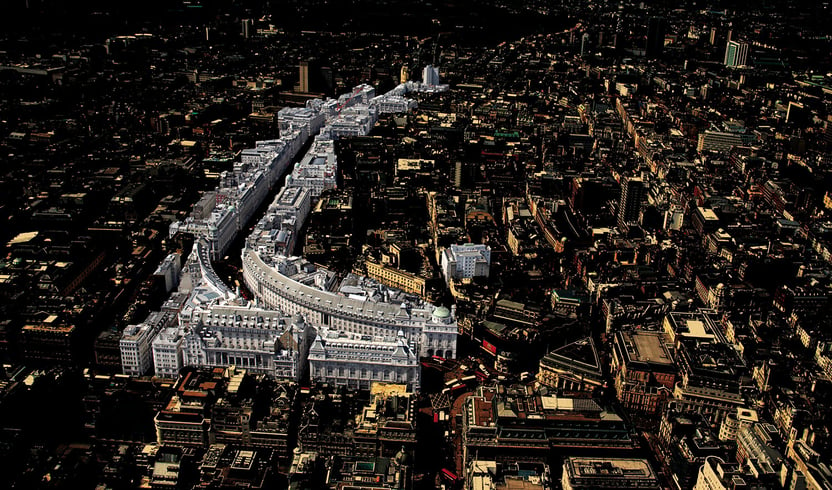

Did you know that the fund has a 25 percent stake in London’s Regent Street? The investment was announced in 2010 when we entered into a partnership with The Crown Estate and was the fund’s first real estate investment. Photo: Sutton Young.

We invest in office and retail properties in selected cities around the world, and in logistics properties that are part of global distribution networks. These are unlisted investments – in other words, they are not listed on a stock exchange.

We concentrate our investments in a limited number of major cities in Europe, the US and Asia. All have large and transparent real estate markets, are expected to see population and/or employment growth, and have potential for economic growth and increased trade. The cities we have chosen to focus on are: New York, Boston, Washington DC, San Francisco, London, Paris, Berlin and Tokyo. Our investments in these cities are mainly in office and retail properties of a high standard in prime locations.

We invest in office and retail properties in selected cities around the world, and in logistics properties that are part of global distribution networks. These are unlisted investments – in other words, they are not listed on a stock exchange.

We concentrate our investments in a limited number of major cities in Europe, the US and Asia. All have large and transparent real estate markets, are expected to see population and/or employment growth, and have potential for economic growth and increased trade. The cities we have chosen to focus on are: New York, Boston, Washington DC, San Francisco, London, Paris, Berlin and Tokyo. Our investments in these cities are mainly in office and retail properties of a high standard in prime locations.

Our investments in the logistics sector are spread across a wider geographical area. These properties are located close to key transport infrastructure and major population centres.

A film about our real estate management

We invest with partners to benefit from their local knowledge and expertise. To gain access to the most attractive properties, we partner with large and respected investors with a local presence, a long-term investment horizon and interests that align with ours. We invest in real estate through subsidiaries to ensure good risk management and protect the fund’s assets.

The return on unlisted real estate investments depends on rental income, operating costs, changes in the value of properties and debt, movements in exchange rates, and transaction costs for property purchases.

Responsible real estate management

We manage the properties in our portfolio in a responsible and environmentally sustainable manner, as we believe that this supports our objective of the highest possible long-term return. We work with our investment partners and asset managers to integrate sustainability improvements into the business plans for the properties. We have also published a guidance document on responsible management of unlisted real estate, which provides a basis for our dialogue with investment partners and asset managers.

Our holdings

Search in the fund's unlisted real estate investments or download lists sorted by country and sector. The information is updated annually.

Listed real estate

The fund's real estate strategy includes both unlisted and listed real estate investments. The fund's investments in listed real estate companies have exposure to high-quality properties in attractive cities and sectors globally that complement the fund’s unlisted real estate portfolio. The listed portfolio is mainly invested in the residential, office and retail sectors. Geographically, it is split almost equally between the US and Europe.

Our investments in listed real estate companies can be found under “Equities” in the fund’s main holdings list.

Last saved: 24/05/2023