Additional information on coal related operations

13 December 2018

We refer to the Ministry’s letter of 28 June 2018 following up Report to the Storting No. 13 (2017-2018) “The Government Pension Fund 2018”. In its letter the Ministry ask Norges Bank amongst other things to describe its work on assessing the observation and exclusion of companies under the coal criterion. In our reply letter of 25 October 2018 we provided our description of this work, including a description of the extent of coal-related operations at companies excluded or placed under observation, and at companies not excluded or placed under observation.

In its letter of 26 November 2018 the Ministry asks the Bank to expand on its description and assessment of companies not excluded or placed under observation, including the number of companies, the distribution in terms of size, as well as shares of capacity and extraction and possible plans to change the revenue or capacity shares of thermal coal. Below and in the attachments we provide such additional information.

As pointed out in our previous letters of 31 August 2015 and 31 January 2017 concerning the coal criterion, access to information is a challenge when implementing the coal criterion. There are no single sources covering all relevant companies, and the information reported by companies themselves is not normally detailed enough for the analysis required. We have therefore contacted multiple suppliers. While the average levels from different data sources are comparable, the individual data points can vary substantially.

We can nevertheless provide estimates of the extent of coal-related operations in companies not excluded or placed under observation. As in our letter of 25 October 2018, we base our estimates for power production on last available data from World Electric Power Plants database, and for thermal coal production we have looked at information disclosed by companies we have identified as having coal production as part of their business. The coal criterion includes consolidation, where production at subsidiaries are taken into account when parent companies are assessed and compared against the thresholds in the criterion. Thus, we include subsidiaries in the figures provided for parent companies’ production of coal-based power, production of thermal coal, and market value of holdings in our benchmark index for equities.

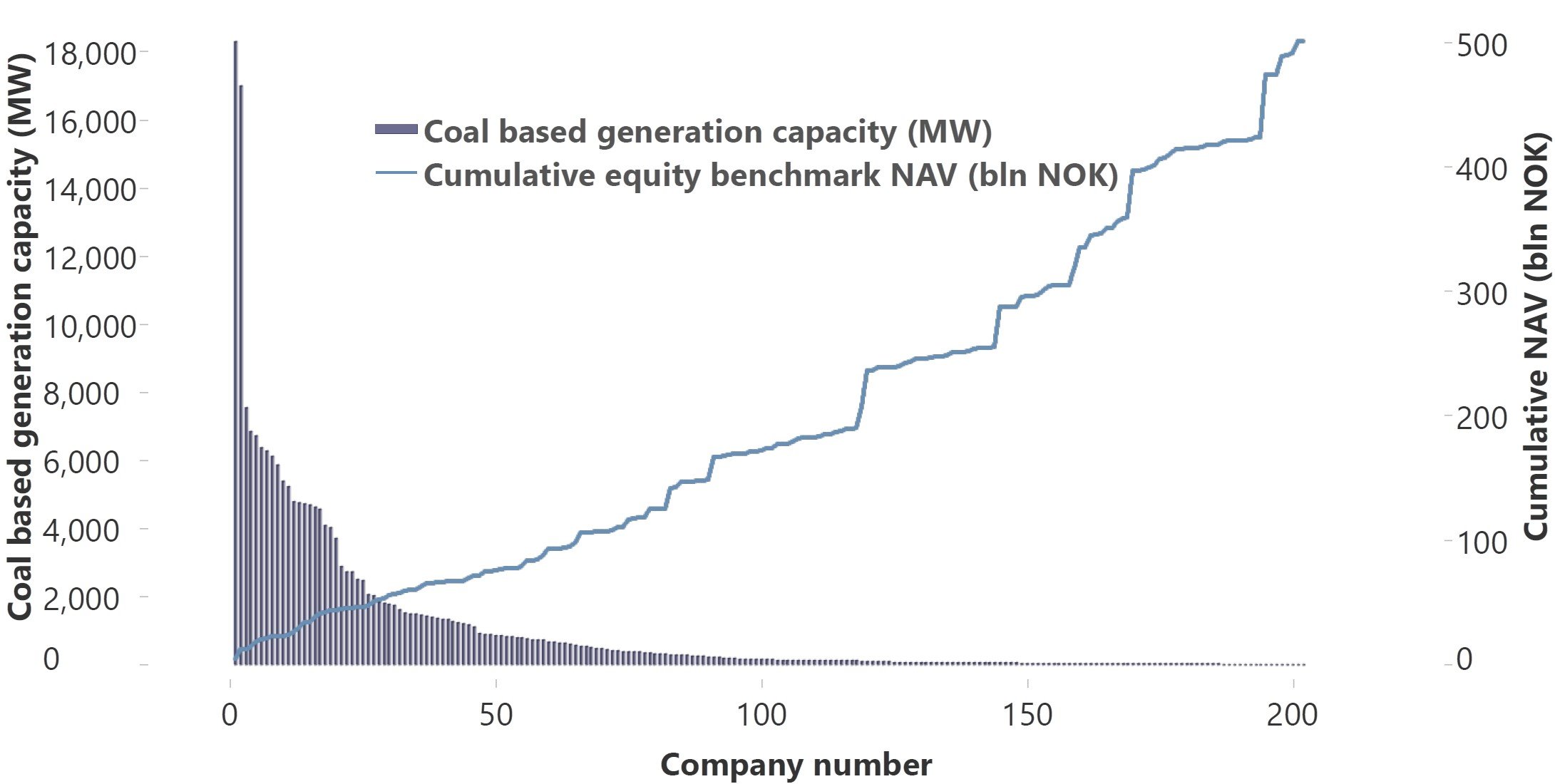

Chart 1 shows companies’ coal-based power capacity in bars, while accumulated market value of holdings in our benchmark index is represented by the line. As shown in the chart, most of the remaining coal-based power capacity is found among the largest companies by coal-based power capacity. Most of the companies do not have power production as their main business. There is a long tail of companies that have some coal-based power capacity, and some of these companies are engaged in other operations of considerable size. As such, there are notable jumps in the accumulated market value of holdings in the benchmark index. The chart data is found in the attachments to this letter.

Chart 1 Companies’ coal-based power capacity and market value of holdings in the benchmark index. Last available data, market values as at 30 September 2018. Source: Norges Bank Investment Management and World Electric Power Plants database (Platts Energy)

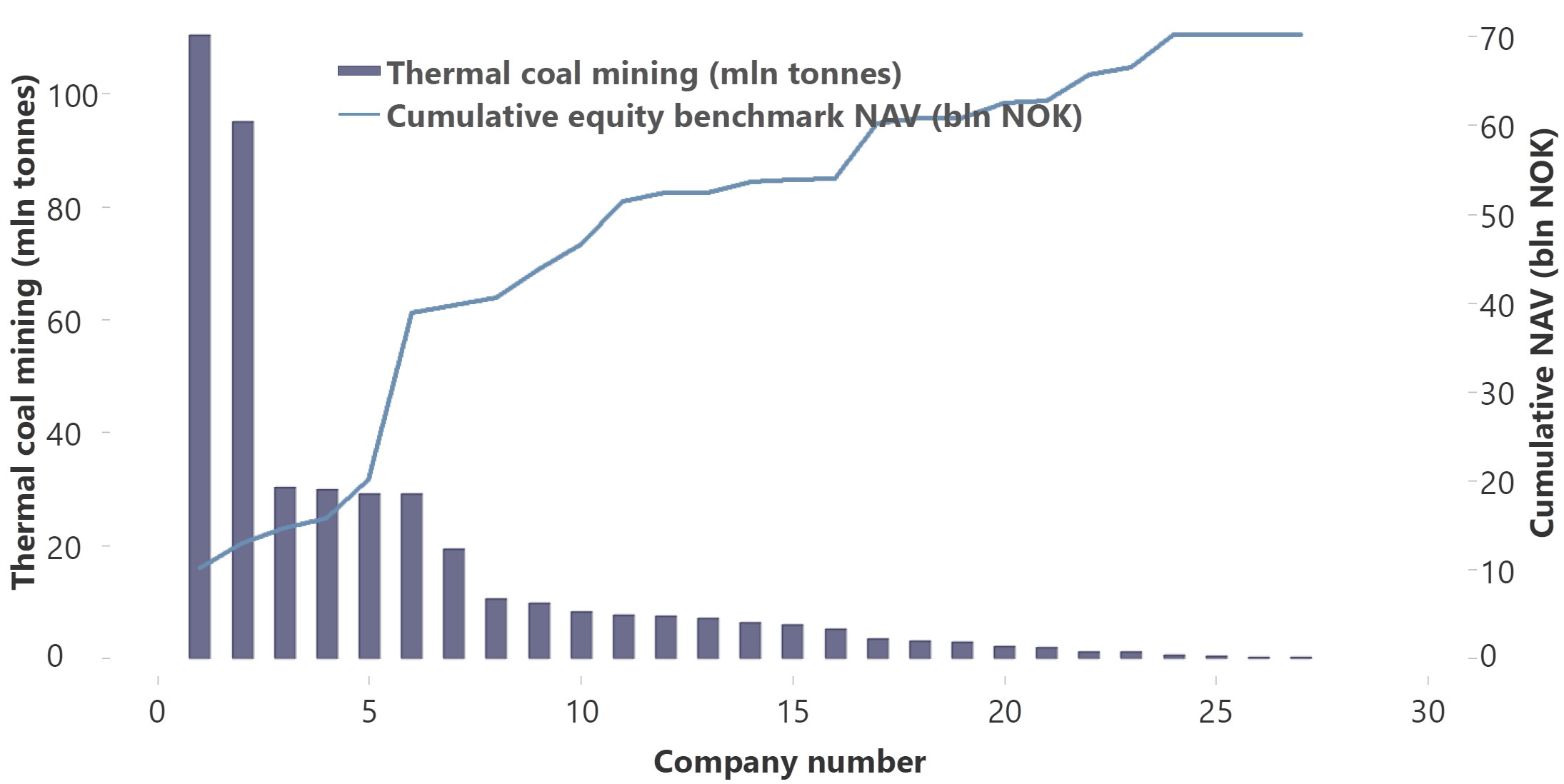

Chart 2 provides an overview of remaining companies’ production of thermal coal. The overview is based on information disclosed by companies and our own calculations. The chart data is found in the attachments to this letter.

Chart 2 Companies’ production of thermal coal and market value of holdings in the benchmark index. Last available data, market values as at 30 September 2018.

Regarding the Ministry’s question on companies’ possible plans to change the revenue or capacity shares of thermal coal, we find it is more challenging to obtain information that can provide a total overview. Forward-looking assessments are necessary in the assessment of individual companies. Purchases or sales of assets or companies may have great significance for the fuel mix of power production or the share of thermal coal in total mining operations. Such actions may thus decide whether a company are considered above or below the thresholds of the coal criterion. However, we do know that a number of relevant companies are engaged in change processes, among other things aimed at increasing the share of renewable energy.

Yours sincerely

Dag Huse Patrick Du Plessis